We Buy and Sell Gold Bullion…

At Vermillion Enterprises, we buy and sell gold bullion. Even silver and platinum! Whether it be bars or coins – we have it all! We want it all! Where we will take the bull, out of bullion. The best place to get top dollar for your gold or turn your cash into an investment!

| GOLD BARS

Whether you buy or sell gold bars, Vermillion Enterprises is where it is happening! |

|

| GOLD COINS

We buy and sell many gold coins. From varying designs, to varying weights. American. Foreign. Whether you are looking to collect or invest. Vermillion Enterprises buys and sells gold coins. |

|

|

From Gold Bars, to Gold Rounds, to Certain Gold Coins. Including American Gold Eagles.

|

Gold: Be-All-In on Knowing Your Investment

Gold Bullion is an alternative to traditional currency when it comes to diversifying your assets or investing. It has stood the test of time! For hundreds of years, gold bullion has been traded in various methods – i.e. bartering and currency exchange. Physical Gold bullion, is an asset worth having around.

Not only because of it’s financial value, but it is something easily liquidated, as needed, when needed. Just remember though… It is always best to speak to a reputable and trusted bullion dealer concerning any aspect of precious metals investing.

Ideally, one you can establish a long-term dealing relationship with. Vermillion Enterprises, where we strive to offer you the best customer service and rates in town. We are here to help you through the process of buying and/or selling gold bullion.

What kind of Gold Bullion does Vermillion Enterprises BUY or SELL?

The most popular gold bullion products include Gold Bars, American Gold Eagles, American Gold Buffaloes, Australian Gold Nuggets, Australian Gold Lunars, Austrian Gold Philharmonics, Canadian Gold Maples, Chinese Gold Pandas, and South African Gold Krugerrands.

Take a gander at our Virtual Shop. There you can view items more commonly found within the shop on Spring Hill Dr. To place an order, please call us at: (352) 585-9772, Message us on Facebook, or use our website Chat to Text on the lower right.

Just remember – If you are looking for something you do not see on the website – Call us! We may have more in shop items in stock that may not have made it to the website yet.

Your options for buying gold bullion at Vermillion Enterprises, is extensive! Let’s take a look at some of the options.

Gold Bars:

Gold Bars are referred to as gold ignots, gold bricks, or gold bullion bars.

They are often in the following sizes:

- 1 gram .999 Gold Bars

- 2.5 gram .999 Gold Bars

- 5 gram .999 Gold Bars

- 10 gram .999 Gold Bars

- 1 oz .999 Gold Bars

- 100 gram .999 Gold Bars

- 5 oz. .999 Gold Bars

- and up!

Gold bars have been around since way before our ancestors even set foot on American soil. Gold coins on the other hand, go even further back! 600 B.C. being the most notably recorded date. However, investment quality bars and coins are different. Let’s explore the Gold Bullion Coins.

Looking for Florida Guidelines on Buying or Selling Gold Bullion in Florida? CLICK HERE!

Know the Difference Between Gold Bullion Bars and Gold Bullion Coins

While all forms of pure gold have significant monetary value, not all investment-quality gold is equal. From an investment perspective, investors wanting to add the physical product that tracks the price of gold may wish to avoid gold numismatics.

Investment-quality coins often feature attractive designs, have historic value, and may have less gold in them (i.e. 1/2 oz. American Gold Eagle), but still, cost more due to their numismatic value.

For instance

One of the most valuable gold coins sold in recent years was a 1933 Saint-Gaudens Double Eagle. It sold for $7.6 million! The 1933 Saint-Gaudens Double Eagle gold coin was minted in 1933 with a Face Value of $20.

Although 445,500 coins of this Saint-Gaudens Double Eagle were minted in 1933, none were ever officially circulated. All but two were ordered to be melted down.

In 1933 President Franklin D. Roosevelt halted private gold ownership in excess of $100 in an attempt to put a stop to the banking crisis. Congress followed with the Gold Reserve Act of 1934, which outlawed the circulation and private possession of U.S. gold coins for general circulation.

The only exception being collector coins.

Yet, somehow, twenty of these Double Eagles managed to survive. Nine of the recovered twenty coins were destroyed. Just ONE of the remaining is privately owned. Thus, making them extremely rare AND extremely valuable gold coins! Definitely worth more than their original $20.00 Face Value now.

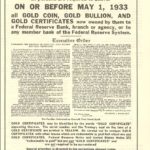

A copy of President Franklin D. Roosevelt’s Executive Order 1602 – Forbidding the hoarding of gold coin, gold bullion, and gold certificates.

The Great Gold Melt = Rare Gold Coins

Buyers and collectors of gold coins have a basic choice between classic U.S. gold coins widely known as Pre-1933 US Gold Coins that circulated in the United States until that year, and modern gold bullion coins. What makes Pre-1933 Gold Coins different than modern gold bullion coins?

On April 5, 1933, President Franklin D. Roosevelt put Executive Order 1602 on the table! Basically, private ownership of gold bullion, including bars and coins, was outlawed! Roosevelt’s order stated that “the hoarding of gold coin, gold bullion, and gold certificates within the continental United States” was “forbidden.”

By 1934, millions of coins were melted down because of the Gold Reserve Act of 1934. Coins that survived have become very valuable due to their rarity.

Fast track to 1974, President Gerald R. Ford, repealed the gold limitation and thus, enter the modern gold bullion coin.

What is the most invested/traded modern gold coin? Well, that would be the American Gold Eagle!

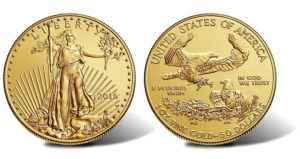

American Gold Eagles

Following the Gold Bullion Coin Act of 1985, the American Gold Eagles first made their debut in 1986. Issued in burnished, uncirculated, and proof finishes. They are available in 1 oz, 1⁄2 oz, 1⁄4 oz, and 1⁄10 oz coins.

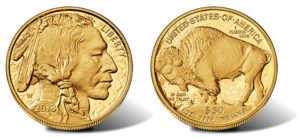

American Gold Buffaloes

The American Buffalo, also known as a gold buffalo, is a 24-karat, or .999, bullion coin first offered for sale by the United States Mint on June 22, 2006. It debuted after the Presidential $1 Coin Act of 2005.

Australian Gold Nuggets

The Australian Gold Nugget, is not just a nugget of gold. It is an actual coin! First minted in 1986 by the Perth Mint.

The Australian Gold Nugget coin is available in 1⁄20 oz, 1⁄10 oz, 1⁄4 oz, 1⁄2 oz, 1 oz, 2 oz, 10 oz, and 1 kg of 24 carat gold. They are one of the few gold legal tenders in Australia to change their design every year.

Australian Gold Lunars

In 1996, Australia debuted their Australian Gold Lunar series. Designed to honor the 12-year Zodiac based on Chinese influence on the economy.

Beginning with the Year of the Mouse (Rat) in 1996, and ending with the Year of Pig in 2007. However, in 2008, the Perth Mint introduced the Lunar Series II.

However, these vary greatly from the original series. In addition to gold bullion and proof versions of the coin, special commemorative coins were struck, high-relief proofs, and even colorized designs that added visual brilliance to each of the coins produced by the Perth Mint.

Additionally, this year – 2020 – marks the beginning of a New Lunar start. The Perth Mint has celebrated it with a Lunar III series.

Austrian Gold Philharmonics

Originally minted in 1989 by the Austrian Mint, the Austrian Gold Philharmonic is available in two sizes; 1⁄2 oz and 1 oz. The Austrian Gold Philharmonic bullion coin is the only coin that has a face value in euros to date.

This Philharmonic coin is one of the world’s best selling coins in 1990. By 2012, there had been more than 14 million Philharmonics sold WORLDWIDE. Can you guess how many TONS of gold that is? Over 329 tons of gold bullion!

Canadian Gold Maple Leafs

The Canadian Gold Maple Leaf was first issued by the Royal Canadian Mint in 1979. The Royal Canadian Mint presented the Gold Maple Leaf at a point in time when coin investors had only one choice: the South African Gold Krugerrand.

The coins were more than just the second gold bullion coins introduced for private investment. They also became the first-ever .9999 pure gold (24-karat) coins in the world when the mint increased gold purity in the coins in November 1982.

Chinese Gold Pandas

First released in 1982, the China Shenzhen Mint’s Gold Panda series is now among the most popular coins worldwide. Initially, they only offered sizes of 1⁄10 oz, 1⁄4 oz, 1⁄2 oz, and 1 oz. However, the 1⁄20 oz quickly made an appearance.

On the gold bullion version of the Gold Panda, the design on the reverse side of the coin, has been changed EVERY year since it’s first release in 1982.

South African Gold Krugerrands

The Krugerrand first appeared in 1967. It was a time in which the public first started investing in personal gold coin portfolios. Derived from the former President of South Africa, Paul Kruger, and the rand, a South African unit of currency.

The United States saw a high importation of Krugerrand coins between 1974-1985. 22 million coins to be exact! It is available in 1⁄10 oz, 1⁄4 oz, 1⁄2 oz, and 1 oz sizes.

Looking for Florida Guidelines on Buying or Selling Gold Coins in Florida? CLICK HERE!

Why buy or sell gold bullion coins at Vermillion Enterprises?

Simply put, Vermillion Enterprises has, for over 6 years, built a reputation on fair prices, honest trade practices, and great customer service.

So if you live in or near Spring Hill, Lutz, New Port Richey, Hudson, Crystal River, Inverness, Brooksville or surrounding Florida counties – Pinellas, Hillsborough, Citrus, stop in and say hi! Come on in or check out our online SHOP! We have gold bullion to buy from you OR plenty of gold bullion sell to you!